Chiropractic (bone popping) and Homeopathy are my guesses

Chiropractic (bone popping) and Homeopathy are my guesses

Plasma - liquefy?

You misspelled “vaporize”

Oh.

I misinterpreted this, thinking it was showing me savings on shipping and such.

Instead, I think it’s referring specifically to savings on purchases that were Prime Exclusive Deals or maybe Prime Early Access.

Apologies for the wild goose chase.

I see those too if I scroll down further. I’m using this version on Pixel 5 with Android 14.

Amazon App Version 26.23.4.100 Build 18.0.336079.0

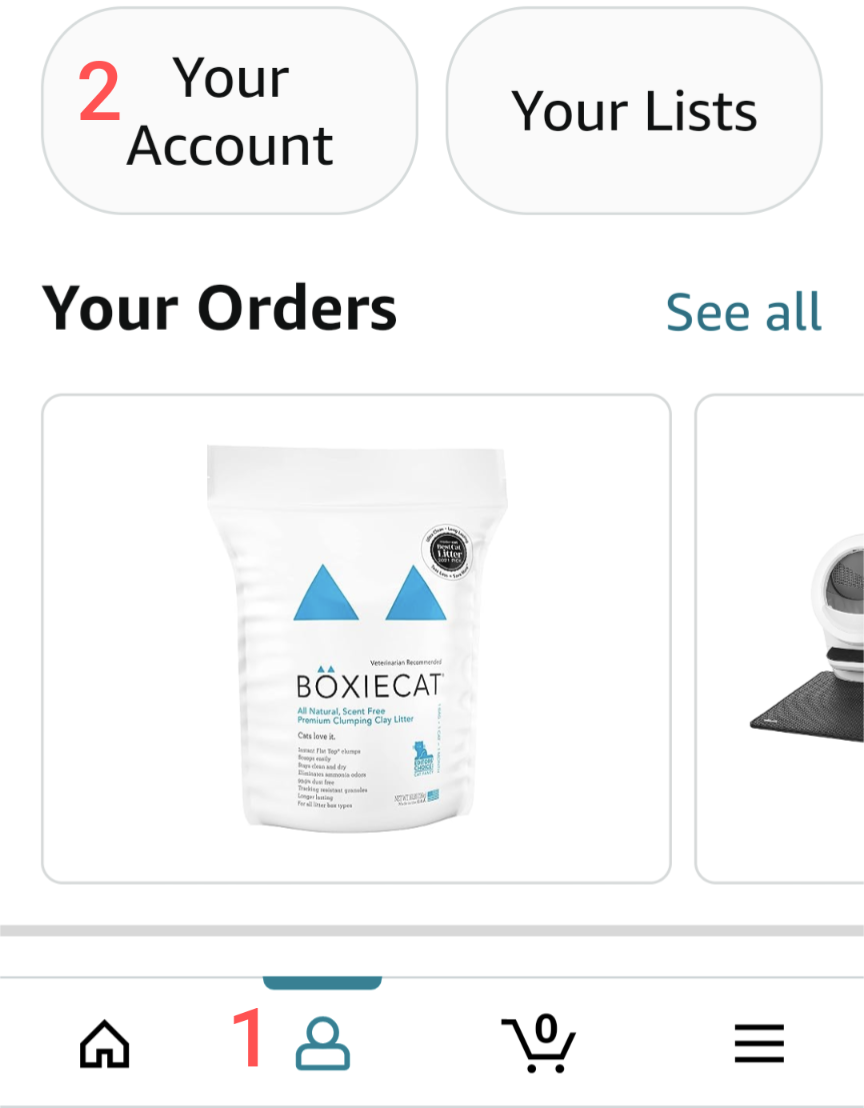

In the app open your profile (1) and then your account (2):

Then scroll down to Account Settings to (3) Manage Prime Membership:

And scroll down to (4) Your Prime deals and discount savings:

This is what it looks like for me:

In the Prime app, you can see how much you’ve saved with Prime over the last year… Looks like it will be cheaper for me to just cancel outright.

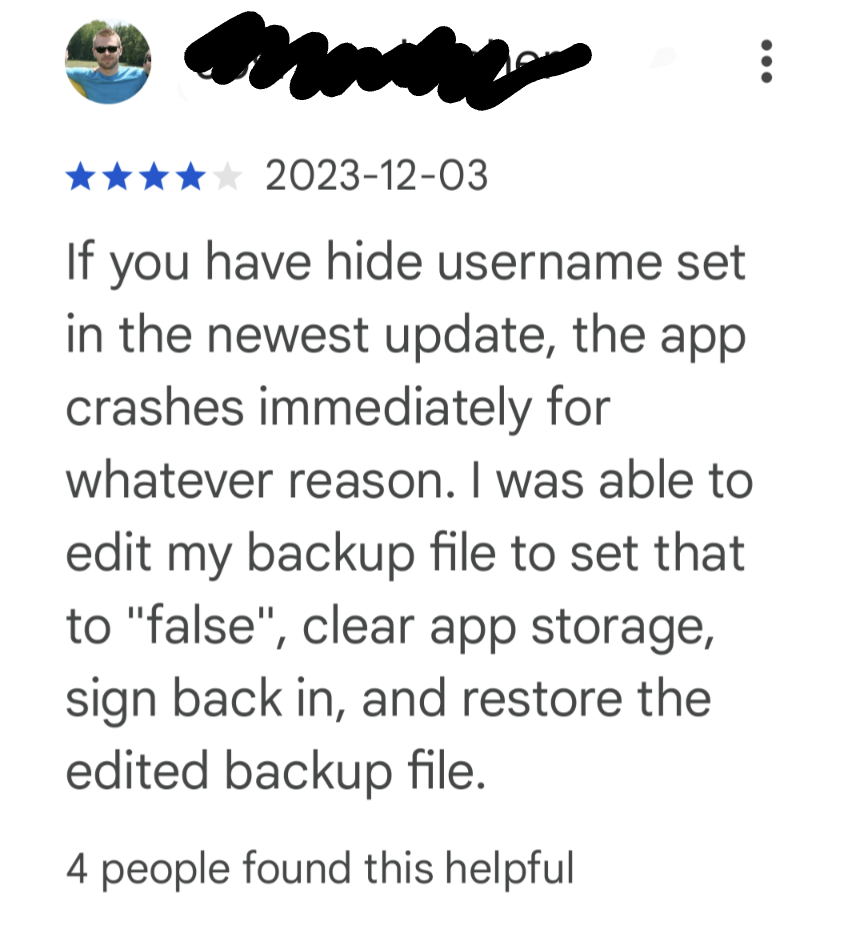

This is not my comment from the Play store, it’s from another Sync user having a similar issue:

Play store link: Sync for Lemmy

deleted by creator

Dang, you woke Murphy. I hate it when that happens.

Antidepressants and industrial-strength denial.

The Canadian House Hippo agrees.

Oh good. Let’s do Homeopathy next.

No mention of modems at all … :-(

All things considered, I would too.

The downsides are having to report Capital Gain, and losing the ability to report Capital Loss.

You just weigh those costs (tax owing for capital gain, or loss of tax credit for capital loss) to see if they are sufficiently offset by the expected returns.

Please forgive me for doing a straight paste from the Canada Revenue Agency page:

"You can also make “in kind” contributions (for example, securities you hold in a non-registered account) to your TFSA, as long as the property is a qualified investment.

You will be considered to have disposed of the property at its FMV at the time of the contribution. If the FMV is more than the cost of the property, you will have to report the capital gain on your income tax and benefit return. However, if the cost of the property is more than its FMV, you cannot claim the resulting capital loss. The amount of the contribution to your TFSA will be equal to the FMV of the property."

ALL YOUR BASE ARE BELONG TO US

Folks.