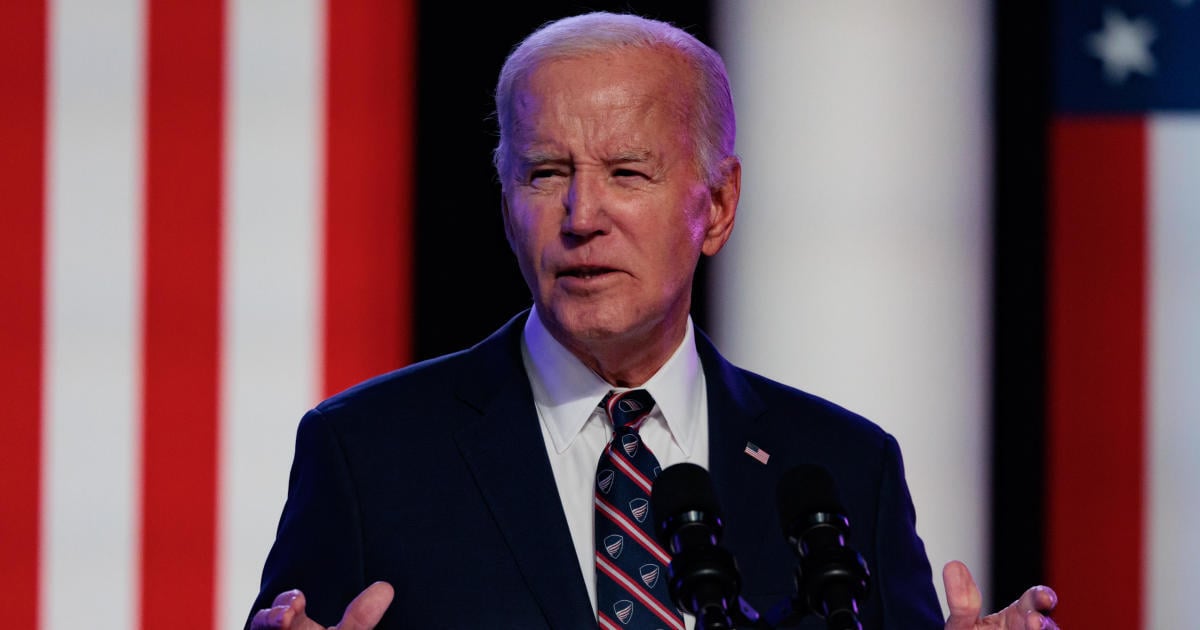

President Biden announced Friday that his administration is forgiving $5 billion in student debt for another 74,000 borrowers, marking the latest round of debt cancellation since the Supreme Court voided the president’s student loan forgiveness program.

Mr. Biden said that of the borrowers who can receive relief, nearly 44,000 are teachers, nurses, firefighters and others who are eligible for forgiveness after working 10 years of public service. Almost 30,000 of those who will have their debt wiped clean have been repaying their loans for at least 20 years, but did not get the relief they earned through income-based plans, the president said.

With the latest round of student loan forgiveness, more than 3.7 million Americans have had their debt erased under the Biden administration, Mr. Biden said.

He did do a lot more! I mentioned it in another comment a week ago, but look into what his save plan does. Lowers costs, lowers interest, increases forgiveness, etc. etc.

Save plan lowered my effective interest rate to around 2%. I’ll still have to pay a lot over the next 20 years, and if the tax bomb is not removed it will be another 100,000. However my cash flow is much improved and how much I pay total has decreased drastically.

Still fighting with my student loan servicer to set me up on the plan correctly, but that is a different can of worms. The servicers need to have their contracts nullified for how terrible they have been.

Definitely better than a kick in the teeth, but it’s a shame the Supreme Court nixed the bigger loan forgiveness plan. I’m glad to see Biden is still trying to live up to his promise as much as he can given the obstructionist Congress and Supreme Court.

Here in Australia, our student loans are given and managed by the Australian Tax Office, and while they technically don’t accrue interest they are “indexed” according to inflation (CPI specifically) once per year, every year. Our repayments just come out of or income like regular income taxes - that means that the repayments are tax-deductible too. We usually get indexed around 2-3% per year but last year it was almost 8% which hit really hard. Most degrees also fall under the Higher Education Commonwealth Support (HECS) program which drastically reduces their total cost too.